Introduction:

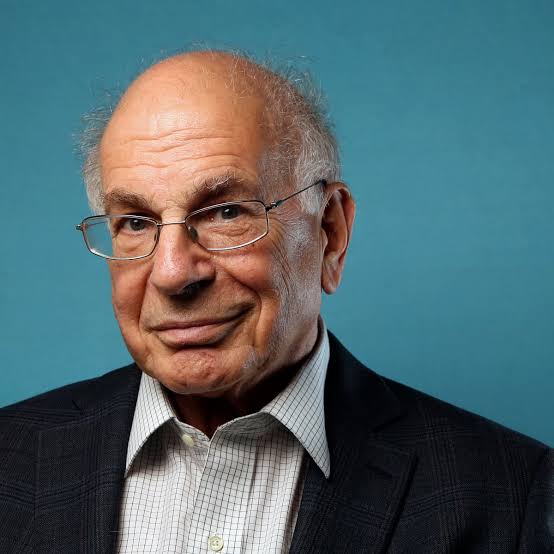

Daniel Kahneman, a Nobel laureate in Economic Sciences, has fundamentally changed the way we think about human judgment and decision-making. His work challenges the classical economic assumption that people are rational agents who always make decisions in their best interests. Kahneman’s groundbreaking research, particularly in collaboration with Amos Tversky, introduced key insights into how cognitive biases and heuristics influence judgment. This has not only impacted psychology but has also had far-reaching effects on economics, medicine, and policy-making.

Early Life and Academic Journey:

Kahneman’s journey into the world of psychology began with an early interest in human behavior, shaped by his experiences during World War II. Born in Tel Aviv in 1934 and raised in France during the Nazi occupation, his early life played a role in forming his views on uncertainty, risk, and human resilience.

He pursued psychology, earning his Ph.D. at the University of California, Berkeley, where he began his collaboration with Amos Tversky. Together, they would unravel some of the deepest mysteries of how humans process information and make judgments.

Heuristics and Biases: The Foundation of Judgment Errors

One of Kahneman’s most influential contributions is his exploration of cognitive biases. He identified that people often rely on heuristics—mental shortcuts—to make decisions. While these shortcuts are efficient, they also lead to systematic errors in judgment.

- Availability Heuristic: We tend to estimate the likelihood of events based on how easily we can recall examples. For instance, after watching news reports about airplane crashes, people might overestimate the risk of flying, despite statistics showing it’s much safer than driving.

- Representativeness Heuristic: This involves making judgments based on how similar something seems to a typical case. Kahneman and Tversky showed that people often ignore statistical base rates and focus on anecdotal evidence when evaluating probabilities.

- Anchoring: People’s decisions are heavily influenced by an initial piece of information, or “anchor.” For example, when negotiating a salary, the first offer often sets the range for the final deal, even if it’s arbitrary.

Prospect Theory: A New Model of Decision-Making

Perhaps Kahneman’s most famous contribution is Prospect Theory, developed with Tversky in 1979. This theory describes how people choose between probabilistic alternatives that involve risk, where the probabilities of outcomes are uncertain. The key insights from Prospect Theory are:

- Loss Aversion: People tend to weigh losses more heavily than gains. For example, the pain of losing $100 is greater than the pleasure of gaining $100, which explains why individuals often avoid risk, even when it would lead to potential benefits.

- Framing Effects: The way a decision or problem is presented (framed) can drastically affect choices. For example, people are more likely to opt for a medical procedure if it’s described as having a 90% survival rate than if it’s framed as having a 10% mortality rate.

These insights explain why people often make decisions that seem irrational from a purely economic perspective, but make sense when considering psychological influences.

System 1 and System 2 Thinking: Understanding the Mind’s Dual Systems

In his widely-read book “Thinking, Fast and Slow,” Kahneman elaborates on the idea of two systems of thinking:

- System 1: Fast, automatic, and intuitive. This system is what we use for most of our daily judgments. It’s prone to errors because it’s based on heuristics and immediate perceptions.

- System 2: Slow, deliberative, and analytical. It requires effort and concentration but is more accurate. However, people often don’t engage System 2, relying on System 1 for convenience.

Kahneman explains that while System 1 is useful for quick decisions, it can lead to mistakes in complex or important judgments, as it is influenced by biases and errors.

Kahneman’s Impact Beyond Psychology

Kahneman’s work has transcended psychology, influencing fields such as economics, finance, medicine, and public policy. His insights into judgment and decision-making have been applied to improve:

- Behavioral Economics: Kahneman’s research has shown that people are not always rational actors, a key assumption in classical economics. His work has laid the foundation for behavioral economics, which integrates psychological insights into economic models.

- Nudge Theory and Public Policy: Kahneman’s work has informed “nudge theory,” which suggests small changes in how choices are presented can lead to better decision-making in areas like health, finance, and environmental behavior. Policies inspired by this theory aim to guide people towards better decisions without limiting their freedom of choice.

Conclusion:

Daniel Kahneman has revolutionized the understanding of human judgment and decision-making. His exploration of cognitive biases, heuristics, and the dual-system model of thinking has provided invaluable insights into why we think the way we do. By highlighting the limitations of human rationality, Kahneman has offered a new lens through which to view the complexity of our minds and the decisions we make every day.

His work reminds us that while our mental shortcuts can be useful, they can also lead to systematic errors. Understanding these can help individuals, organizations, and policymakers make better decisions in an increasingly complex world.